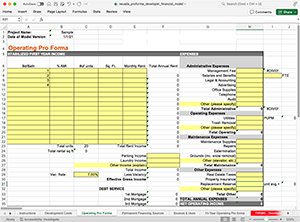

Pro Forma

A real estate proforma is a financial model that takes into consideration your full development costs, property income and operating expenses. It should serve as a starting point for feasibility analysis and will continue to evolve as you get more details. Many funders will have then own proformas, this is a simplified version.

This tool consists of 5 worksheets intended to be completed in the following order:

- Development Costs: Captures the costs to develop your project.

- Operating Pro Forma: Summarizes a rental project's bedroom distribution, income targets, operating income and expenses.

- Permanent Financing Sources: Captures all permanent sources of funds for the development of this project.

- Sources and Uses Statement: Used to show which funding sources will pay for which project development costs.

- 15 Year Operating Pro Forma: Captures income, expenses and cash flow over a 15 year period.

For more context, please see the Pro-Forma Overview.

Glossary

Explore our comprehensive glossary of affordable housing terms, tailored specifically for Nevada and designed to illuminate every phase of the development process. Color-coded to align with the six key stages of your toolkit, this resource is your go-to guide for understanding and navigating the complexities of affordable housing projects. Dive in and equip yourself with the knowledge needed to make informed decisions and drive impactful change in your community.

| 3 | Absorption Rate |

The rate at which available homes are sold in a specific market during a given time period. It is calculated by dividing the number of homes sold in the allotted time period by the total number of available homes |

| 4 |

Accessory Dwelling Units (ADUs) |

a habitable living unit added to, created within, or detached from a primary one-unit Single Family dwelling, which together constitute a single interest in real estate. It is a separate additional living unit, including kitchen, sleeping, and bathroom facilities. https://www.huduser.gov/portal/publications/adu.pdf |

| 3 | Accrued Interest |

The interest that has been incurred on a loan or other financial obligation but has not yet been paid out. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Adaptive Reuse |

Repurposing buildings for new uses and modern functions other than those originally indtended in order to address present-day needs. |

| 4 | Alliquot Lots | Alliquot lots refer to parcels of land managed by the Bureau of Land Management (BLM), typically standardized into five-acre sections known as aliquots. BLM divides land using a large grid map, and if a piece of land does not neatly fit into a five-acre aliquot, BLM may need to conduct a survey to establish appropriate boundaries. These surveys can cause significant delays in the approval process for development projects. |

| 1 | Anchor Institutions | Anchor institutions are schools, institutions of higher education (IHEs), hospitals, faith-based organizations, and community-based organizations that have deep roots in the community and are longstanding contributors to the community’s stability and strength. Often these institutions are the largest employers, purchasers, and landowners in the community and as a result are the largest contributors to the community’s economy and well-being. |

| 2 | Appraisal | A process through which the value of a property is determined by a licensed appraiser. |

| 2 | Audit | An independent examination of an entity's financial statements to ensure compliance with applicable laws and regulations |

| 2 | Below-market | A price or a rate that is below the current market price or rate. |

| 4 | Bid Package |

A set of documents that contain the scope of work, specifications, drawings, and general conditions for a project or job. Prospective contractors should be able to review the bid package and develop their cost estimates and schedules for the work. https://www.directives.doe.gov/terms_definitions/bid-package |

| 3 | Bridge Loan |

A primary loan that “bridges” the financing for a project to another future permanent type of financing. Helps to acquire property quickly, provides temporary financing awaiting more favorable lending terms, or temporarily funds the acquisition portion of a project while gap financing pays for rehabilitation. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Building setbacks |

The distance measured from the property line to any structure, which is unobstructed by structures from the ground upward, but which may include surface driveway areas or other similar surface improvements. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Capital Subsidies |

Any funds provided from a source (generally a unit of local, State, or Federal government) that reduce the amount of financing a borrower needs to obtain from a conventional lender. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 1 | Charette |

A type of participatory planning process that assembles an interdisciplinary team—typically consisting of planners, citizens, city officials, architects, landscape architects, transportation engineers, parks and recreation officials, and other stakeholders—to create a design and implementation plan for a specific project. It differs from a traditional community consultation process in that it is design-based and, while traditional planning exercises can take a long time to be finalized, charrettes are usually compressed into a short period of time. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Climate Resilience |

Includes the capability to anticipate, prepare for, respond to, and recover from significant multi-hazard threats without major disruption to social well-being, economy, and environment. https://toolkit.climate.gov/topics/tribal-nations/capacity-building |

| 4 | Co-Housing | A community of private homes centered around a shared space that may include a large kitchen or dining area, laundry, or recreational spaces. Each private home includes traditional amenities such as a private kitchen. |

| 3 |

Community Development Financial Institution |

Community Development Financial Institutions (CDFIs) are private sector financial institutions that focus primarily on personal lending and business development efforts in poorer local communities requiring revitalization. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Contingency Costs |

An amount included in a budget to account for unforeseen costs or situations not otherwise included in the estimate of project costs. It is typically limited to a certain percentage of the overall budget. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Conventional financing |

Any mortgage loan that is not insured or guaranteed by the government. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 5 | Davis-Bacon and Related Acts |

The Davis-Bacon and Related Acts, apply to contractors and subcontractors performing on federally funded or assisted contracts in excess of $2,000 for the construction, alteration, or repair (including painting and decorating) of public buildings or public works. Davis-Bacon Act and Related Act contractors and subcontractors must pay their laborers and mechanics employed under the contract no less than the locally prevailing wages and fringe benefits for corresponding work on similar projects in the area. https://www.dol.gov/agencies/whd/government-contracts/construction |

| 3 |

Debt Service Coverage Ratio (DSCR or DCR) |

metric that looks at a property’s income compared to its debt obligations. Properties with a DSCR of more than 1 are considered profitable, while those with a DSCR of less than one are losing money. DCR/DSCR is an essential part of the decision-making process when a commercial or multifamily lender decides whether to issue a loan. In general, if a property has an abnormally low DCR/DSCR, they will have difficulty paying back their loan on time. This is why the majority of lenders like borrowers to have DSCRs of at least 1.15- 1.25x. https://www.multifamily.loans/debt-coverage-ratio |

| 3 | Deed restriction |

A limitation on how a property can be used that is tied to the deed, which is a legal document that defines who owns a particular property. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Density |

The ratio of a particular type of land use per given area of land. Density measures the intensity of a given land use and is subject to zoning regulations. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Design Concept |

A design concept is the broad idea for the design of your affordable housing project. It should be completed by an architect in conjuction with the project team. |

| 3 | Developer Fees | The developer fee is compensation to the project developer for the time and resources spent to develop the project. This is basically the incentive for developers (often times for-profit developers) to develop affordable housing. |

| 3 | Development financing |

Development finance is the efforts of local communities to support, encourage and catalyze expansion through public and private investment in physical development, redevelopment and/or business and industry. It is the act of contributing to a project or deal that causes that project or deal to materialize in a manner that benefits the long-term health of the community. https://www.cdfa.net/cdfa/cdfaweb.nsf/pages/df.html |

| 3 | Due Diligence | Due Diligence is the general practice of ensuring a sound investment. Funding sources will have different due diligence standards that all projects must comply with in order to receive funding. |

| 1 | Economies of Scale | The cost advantage that arises due to scale of operation with the cost/unit of output generally decreasing with increasing scale as fixed costs are spread out over more units of output. |

| 3 | Encumbrances | Encumbrances may include leasehold mortgages, easements, and other contracts or agreements that by their terms could give to a third party exclusive or nearly exclusive proprietary control over tribal land. |

| 4 | Endangered Species act |

The Endangered Species Act (ESA) of 1973 is a key legislation for both domestic and international conservation. The act aims to provide a framework to conserve and protect endangered and threatened species and their habitats. Your environmental review must consider potential impacts of the assisted project to endangered and threatened species and critical habitats. https://www.hudexchange.info/programs/environmental-review/endangered-sp... |

| 4 | Energy Performance Contracts |

An innovative financing technique that uses the cost-savings from reduced energy consumption to repay the cost of installing energy conservation measures. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Equitable Development |

A comprehensive process of planning and investments that tackles deeply entrenched community issues of poverty, economic barriers, environmental quality, and health. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Equity |

Equity financing involves selling a portion of ownership of a project in return for capital. Limited Partners are outside investors investing in your project in exchange for an ownership stake. The General Partner equity is the equity contributed by the owner/developer of the real estate project. Equity financing does not require repayment and provides all equity investors incentive to maximize returns. There are different types of equity, and they can be raised from real estate funds, high net worth individuals, family offices, crowd sourcing, etc. https://3emanagement.org/blog/how-to-secure-investors-for-real-estate-de... |

| 3 | Escrow | A writing, deed, money, stock, or other property delivered by the grantor, promissor or obligor into the hands of a third person, to be held by the latter until the happening of a contingency or performance of a condition, and then by him delivered to the grantee, promisee or obligee. |

| 1 | Exclusionary Zoning |

The use of zoning ordinances to exclude certain types of land uses from a given community, especially used to regulate racial and economic diversity. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 6 |

Extremely Low-Income (ELI) |

Families that fall below 30 percent of the Area Media Income (AMI). |

| 3 | Fiscal year | A one-year period of time that a company or government uses for accounting purposes and preparation of its financial statements. |

| 4 |

Fish and Wildlife Coordination Act |

Authorizes the Secretaries of Agriculture and Commerce to provide assistance to and cooperate with Federal and State agencies to protect, rear, stock, and increase the supply of game and fur-bearing animals, as well as to study the effects of domestic sewage, trade wastes, and other polluting substances on wildlife. This will be considered in any Environmental Review process. |

| 5 | Floor Area Ratio |

The relationship between the total amount of usable floor area that a building has, or has been permitted to have, and the total area of the lot on which the building stands. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 6 | Foreclosure |

The action of taking possession of a mortgaged property when the mortgagor fails to keep up with their mortgage payments. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Gap Financing |

An interim loan given to finance the difference between the borrower’s primary loan and available cash on hand. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 1 | Gentrification |

The process of neighborhood change that includes economic change in a historically disinvested neighborhood by means of real estate investment and new higher income residents moving in, as well as demographic change, not only in terms of income level but also in terms of changes in the education level or racial make-up of residents. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Green Building |

Building that, in its design, construction, or operation, reduces or eliminates negative impacts, and can create positive impacts on our climate and natural environment. Green buildings preserve precious natural resources and improve our quality of life. https://Nativehomeownership.enterprisecommunity.org/home-design-and-cons... |

| 3 | Gross Income | Gross income refers to the total earnings a person receives before paying for taxes and other deductions. |

| 3 | Hard Costs |

Costs that are directly related to the construction project—land acquisition, materials and/or labor for construction, landscaping, utilities, or infrastructure. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Hard debt | Hard debt means debt for which there is a requirement for repayment and other credit term. Hard debt has a required monthly payment that must be made whether cash is available or not. Often has a first mortgage (first lien) position. |

| 2 | Housing First |

Housing First is a homeless assistance approach that prioritizes providing permanent housing to people experiencing homelessness, thus ending their homelessness and serving as a platform from which they can pursue personal goals and improve their quality of life. This approach is guided by the belief that people need basic necessities like food and a place to live before attending to anything less critical, such as getting a job, budgeting properly, or attending to substance use issues. https://endhomelessness.org/resource/housing-first/ |

| 2 | Housing Subsidy | A housing subsidy pays the difference between tenant rent and total rental costs. LIHTC is an indirect federal subsidy used to finance the construction and rehabilitation of low-income affordable rental housing. |

| 3 | Impact Fees |

Payments required by the local governments of new development for the purpose of providing new or expanded public capital facilities required to serve that development. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 5 | Infrastructure | The basic physical and organizational structures and facilities (e.g. buildings, roads, power supplies) needed for the operation of a society or enterprise. |

| 3 | In-lieu fees |

When a developer is required to build units on-site but is allowed to pay a fee as an alternative, the fee is called an “in-lieu fee.” Note that in-lieu fees are sometimes confused with linkage or impact fees; however, they are different. When a program is structured to require fees instead of requiring on-site units, the fee is called an “impact fee” or a “linkage fee.” https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Integrative Design |

The practice of integrative design requires gathering information, prioritizing residents’ experiences, setting objectives for building performance and resident health and comfort, and securing buy-in from all stakeholders. These strategies establish collective priorities from the beginning and ensure they are clearly communicated throughout the design and construction of the development. https://www.enterprisecommunity.org/blog/integrative-design-essential-fr... |

| 3 | Interest rates | The proportion of a loan that is charged as interest to the borrower, typically expressed as an annual percentage of the loan outstanding. |

| 3 | Investor Equity |

Financing provided by owner/investors or the amount of ownership that an investor has in a particular property. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Investors |

Individuals or legal entities who seek to convert surplus cash flow into real estate investments that generate income and returns. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Land Entitlement |

The legal process by which a developer or landowner gains all necessary approvals for a real estate development plan. This can include both land use approvals and financial incentive approvals. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Land Use Controls |

Government ordinances, codes, and permit requirements that restrict the private use of land and natural resources to conform to public policies. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 6 | Lease-Up | The time period for a newly available property to attract tenants and reach stabilized occupancy. This task usually falls to the property manager. |

| 6 | Leasing | The process of leasing or renting out available units. |

| 3 | Leverage |

Leverage is a term with many meanings. In the housing context, it often refers to increasing the potential return of an investment through the use of borrowed or contributed capital, usually from private sources. https://www.minneapolisfed.org/~/media/files/community/indiancountry/res... |

| 3 | Linkage fees |

Such fees link the production of market rate real estate to the production of affordable housing. Residential linkage fees can either be a set price for each new home or can be calculated based on the square footage of the new home. Commercial linkage fees (sometimes called “jobs/ housing linkage fees”) are charged to the developers of new office or retail properties and used to fund the development of affordable workforce housing. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 |

Loan to Value Ratio (LTV or LTVR) |

A loan-to-value or LTV ratio is a metric that compares the size of a loan to the value of the asset. Higher LTVs are generally riskier for lenders, and, for certain loans, can result in higher interest rates. https://www.hud223f.loans/glossary/loan-to-value-ratio-ltv |

| 6 | Low-Income | Families that fall below 80 percent of the Area Median Income (AMI). |

| 1 |

Metropolitan Statistical Area (MSA) |

A metropolitan statistical area (MSA), formerly known as a standard metropolitan statistical area (SMSA), is the formal definition of a region that consists of a city and surrounding communities that are linked by social and economic factors, as established by the U.S. Office of Management and Budget (OMB). |

| 2 | Mixed-Use Buildings |

Mixed-use development is an example of flexible zoning which allows various types of land uses, including office, commercial, residential, and in some cases, light industrial or manufacturing, to be combined within a single development or district. A major purpose of mixed-use zoning is to allow a balanced mix of office, commercial, and residential uses in close proximity to increase convenience to residents and reduce the number of shopping and/or commuting trips needed. Mixed-use developments can range in size from single buildings with apartments located over retail uses, to large-scale projects that include office and commercial space along with hotels, convention centers, theaters, and housing. https://archives.huduser.gov/oup/conferences/presentations/hbcu/sananton... |

| 2 | Multifamily housing | A structure with five or more dwelling units. |

| 4 |

National Environmental Protection Act (NEPA) |

The National Environmental Protection Act's (NEPAs) basic policy is to assure that all branches of government give proper consideration to the environment prior to undertaking any major federal action that significantly affects the environment. All federally funded housing projects must undergo an Environmental review as a part of NEPA. |

| 4 |

National Historic Preservation Act (NHPA) |

The National Historic Preservation Act (NHPA), 16 U.S.C. 470 et seq., directs each federal agency, and those tribal, state, and local governments that assume federal agency responsibilities, to protect historic properties and to avoid, minimize, or mitigate possible harm that may result from agency actions. |

| 3 | Net Income | Gross income refers to the total earnings a person receives before paying for taxes and other deductions. The amount that remains after taxes are deducted is called net income. When looking at a pay stub, net income is what’s shown after taxes and deductions. Net income is always lower than gross income unless the person is exempt from paying taxes and has no deductions. |

| 3 | Net Operating Income (NOI) | Simply put, your Net Operating Income (NOI) is calculated by taking a property's gross income and subtracting operating expenses. |

| 3 | New Market Tax Credits (NMTC) |

Tax credits against Federal income taxes that individual and corporate investors receive in exchange for making investments in Community Development Entities, which are specialized community development financing entities. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 6 | Operating Subsidies |

Payments to owners of affordable housing developments that make the housing more affordable by covering a portion of the ongoing costs of operating the development (aka operating expenses), such as maintenance, taxes, or interest on debt. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 4 | Patents | BLM refers to their land deeds as patents. This will be the legal document you try to attain in the transfer or sale of ownership. |

| 6 | Performance-Based Contracts |

A group or range of financial and non-financial consequences related to the ability of a contractor to meet measurable and achievable performance requirements. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Pre-development |

The phase of a capital project between the origination of the concept and the initiation of design. It is the period of gathering information, exploring options, and making decisions about the direction of a project. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Preference | Preferences are used to add points to each applicant’s score as they apply for Low-Income Housing Tax Credits and help states prioritize projects that meet critical housing needs. |

| 1 | Private-Sector | The private sector is the segment of a national economy that is owned, controlled, and managed by private individuals or enterprises. Meaning non-governmental agencies. |

| 3 |

Project-Based Rental Assistance (PBRA) |

Project-Based Rental Assistance (PBRA) is a type of HUD housing assistance where HUD directly contracts with private landlords to provide affordable housing to low-income tenants at certain properties. https://www.nhlp.org/wp-content/uploads/2018/03/Saving-HUD-Homes-2-FINAL... |

| 4 |

Property Assessed Clean Energy (PACE) |

Property Assessed Clean Energy (PACE) financing is a way to borrow money for clean energy projects. Property owners repay the borrowed funds along with their property taxes and the assessment remains with the property—not with the original borrower—if it has not been paid off by the time a property is sold. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Property Dispossession |

The transfer, gift, or sale of property from one individual to another. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 1 | Public-Sector | Government and government enterprises. |

| 2 |

Qualified Action Plans (QAPs) |

The federal Low Income Housing Tax Credit program requires each state agency that allocates tax credits, generally called a housing finance agency, to have a Qualified Allocation Plan (QAP). The QAP sets out the state’s eligibility priorities and criteria for awarding federal tax credits to housing properties. In some states, the QAP also sets out threshold criteria for noncompetitive 4% tax credits and any state low income housing tax credits. T he QAP is a tool advocates can use to influence how their state’s share of annual low income housing tax credits is allocated to affordable housing properties. Advocates can use the public hearing and comment requirements to convince their housing finance agency to better target tax credits to properties that house people with extremely low incomes, locate projects in priority areas, and preserve the existing stock of affordable housing. http://nlihc.org/sites/default/files/2014AG-259.pdf |

| 1 | Quasi-Governmental Organization |

A government organization that is assigned some or many of the attributes normally associated with the private sector. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 1 | Racial covenants |

Clauses that were inserted into property deeds to prevent people who were not White from buying or occupying land. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Recovery Housing |

Recovery housing is characterized by alcohol-and-drug-free living settings that involve peer support and other addiction recovery aids. https://www.samhsa.gov/homelessness-programs-resources/hpr-resources/aff... |

| 2 | Redevelopment | The replacement, rehabilitation, or repurposing of existing improvements on an already developed site. |

| 1 | Redlining |

The discriminatory practice of denying services (typically financial) to residents of certain areas based on their race or ethnicity. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Rehabilitation | The labor, materials, tools and other costs of improving buildings, other than minor or routine repairs. Includes when the use of a building is changed to an emergency shelter and the cost of this change and any rehabilitiation costs does not exceed 75 percent of the value of the building before the change in use. |

| 3 | Repayment ability | Ability to repay mortgage debt and other monthly obligations. Lenders will assess repayment ability during the lending process. |

| 3 |

Return on Investment (ROI) |

Return on investment (ROI) is a performance measure used to evaluate the efficiency or profitability of an investment or compare the efficiency of a number of different investments. ROI tries to directly measure the amount of return on a particular investment, relative to the investment’s cost. To calculate ROI, the benefit (or return) of an investment is divided by the cost of the investment. The result is expressed as a percentage or a ratio. |

| 4 | Reverter Clause | A reverter clause contains reversionary language that grants BLM the option to reclaim the land under certain conditions. If triggered, such as during construction or due to a failure to obtain a Certificate of Occupancy within five years, the clause requires payment of the fair market value of any structures on the site at that time (e.g., $20 million). Additionally, the project must maintain affordability; failure to do so may also trigger reversion. Historically, mismanagement could prompt BLM intervention, necessitating compensation or return of the land. Understandably, many banks and lenders were critical of this clause which led to barriers for financing. Recently, under the Southern Nevada Public Land Management Act (SNPLMA), the requirement tied to project affordability has been removed, addressing concerns from lenders. Efforts to refine language and improve processes between federal agencies and private lenders are ongoing. |

| 3 | Risk-sharing |

The profits and losses for each member of a group of investors are shared and allocated within the group based on a predetermined formula. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Scoring Criteria | A set of points-based criteria used by states to evaluate projects applying for Low-Income Housing Tax Credits. The applications with the most points receive housing tax credits. |

| 3 | Set aside | Low-Income Housing Tax Credit funds that are set-aside every year from a state’s allocation of housing tax credits and dedicated to specific types of projects. |

| 2 | Single-Family | Single-family residence means a noncommercial dwelling that is occupied exclusively by one family. |

| 3 | Soft costs |

Costs that are not associated directly with construction. Can include architectural design, feasibility or assessment studies, legal costs, permits, fees, surveys, appraisals, project management costs, taxes, marketing or communication expenses, certification costs, closing costs, maintenance fees, or security during construction. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Soft debt | Soft debt means debt for which there is no requirement for repayment, which is deferred or forgiven, debt repayable to a “Related party” such as a loan from a Sponsor to an ownership entity in which the Sponsor has an “Ownership interest,” or debt that is to be repaid only from excess cash flow or upon certain other conditions and is not included in the calculation of “Hard debt.” If there is a mortgage or a deed of trust, typically it is in the second lien position or lower. |

| 3 | Special Assessment |

A charge imposed on real property to help pay for a local improvement that benefits the property. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Stakeholder | A stakeholder is defined as an individual or group that has an interest in any decision or activity of an organization. For the purposes of developing affordable housing you will have both community stakeholders and financial stakeholders who have an interest in your project. |

| 4 | Subdivision |

The act of dividing land into pieces that are easier to sell or otherwise develop, usually via a plat. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Supportive Services |

Services that are designed to provide comprehensive, personalized supports and resources so that individuals and families are able to address the complex issues and challenges that often accompany social or financial vulnerability and may interfere with obtaining long-term housing stability. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 2 | Surplus Property |

Any publicly owned property with utility or monetary value, including capital assets, sensitive items, commodities, equipment, materials, supplies, buildings, and other property, which is obsolete, unused, not needed for a public purpose, or ineffective for current use. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Syndication |

Process that involves multiple banks and financial institutions who pool their capital together to finance a single loan for one borrower. Also can refer to the process of securing tax credits from a pool of investors or selling tax credits to a pool of investors to generate capital for a project. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Syndicators |

Tax-credit syndicators help bridge the gap between the various parties to affordable housing transactions. Syndicators raise money from investors and identify low-income housing projects in which to invest that capital. https://www.nationalequityfund.org/whoweare/aboutlihtc/ |

| 5 | Tap fees |

The charges assessed to install a new water or sewer connection to a municipal or privately owned source. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Tax exempt bonds |

The interest component of bond debt service payments is exempt from Federal and sometimes State and local income taxes for the bond holder. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Tax liens |

A legal claim against the assets of a person or business who fails to pay taxes owed. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 6 | Tenant Income Verification | In order to receive a rental housing subsidy, LIHTC or other, all tenants must certify they meet the eligible income requirements. Depending on the source of your funding, the requirements will vary, but typically tenants are expected to recertify their income on a yearly basis. |

| 6 | Tenant-based rental assistance |

Subsidies paid directly to renters that they can use to rent any private property that meets program guidelines, typically in the form of a voucher. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 1 | Third-party | Services provided by an outside organization |

| 3 | Traditional financing |

The process of obtaining loans from a “brick and mortar” banking institution. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 1 | Transit Hub |

A rail, light rail, or commuter rail station; ferry terminal; or bus transfer station served by or connecting multiple modes of transportation. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 1 | Underutilized |

Land or property that is not fully used and has more potential than is currently being realized. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Underwriting principles |

Guidelines used by a lender to verify income, assets, debt, and property details in order to approve a loan. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 3 | Utility Allowance |

The definition of maximum “affordable” rents for tenants includes both housing and reasonable utility costs. Where some or all utilities are tenant-paid, the rent actually charged to the tenant (the “net rent”) must be reduced by the utility allowance. For most programs, utility allowances approximate the reasonable consumption of utilities by an energy-conservative household of modest circumstances consistent with the requirements of a safe, sanitary, and healthful living environment. Owners of properties financed with LIHTCs must include an allowance for tenant-paid utilities when calculating net tenant rents. Unlike most rental assistance programs, tenants are not limited to paying 30% of actual income for rent and utilities. https://www.nhlp.org/wp-content/uploads/California-Housing-Partnership-C... |

| 4 | Utility Rebates |

Cash refunds or rebates for the purchase and installation of energy-efficient equipment or participation in energy reduction programs. https://files.hudexchange.info/resources/documents/Affordable-Housing-Su... |

| 6 | Vacant turnover | Turnover occurs when a resident chooses to move out instead of renew their lease. Vacant turnover is the maintenance, cleaning tasks, and process of finding a new tenant that occurs when a unit is vacant. Typically housing projects try to maximize vacant turnover time in order to minimize income lost. |

| 6 | Very Low-Income | Families that fall below 50 percent of the Area Median Income (AMI) |